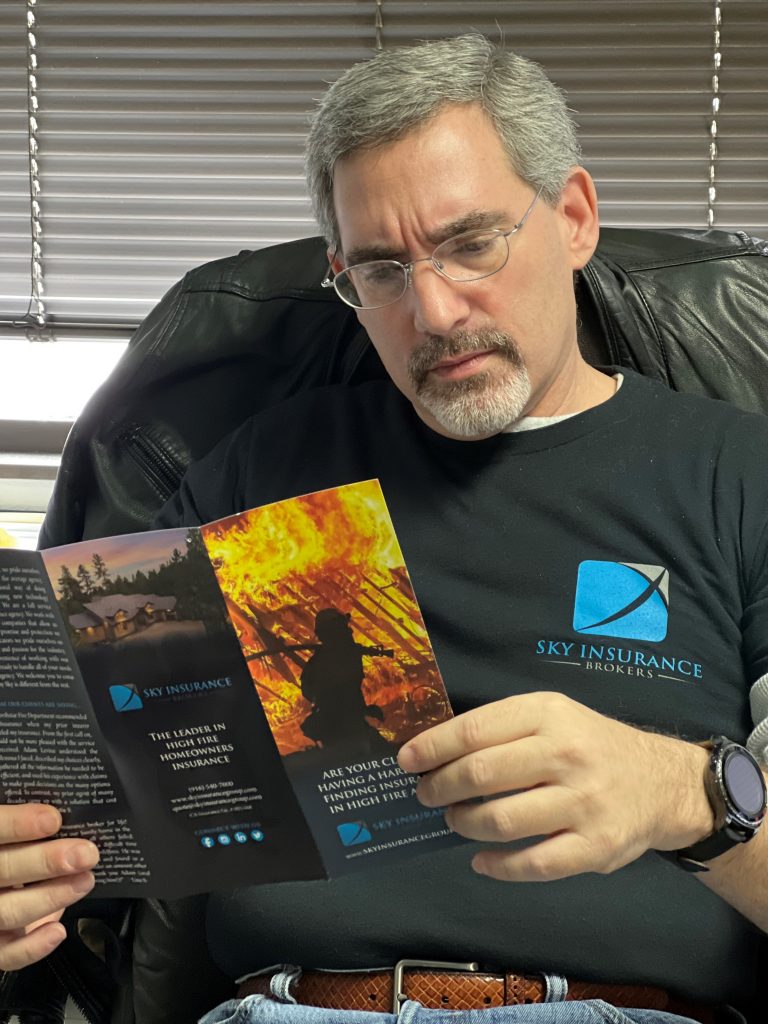

Sky Insurance Brokers acquires Advantage Insurance Services Inc.

Sky Insurance Brokers is pleased to announce it has completed the acquisition of Advantage Insurance Services Inc in Chico, California. Advantage Insurance Solutions was founded in 1984 by Dick and Trish Nelson in San Diego, and they relocated the corporate…